Closing the loop: How Regrowblu is pushing China’s textile industry toward full circularity

12 hours ago

On the west coast of South America, in northern Chile, lies the Atacama Desert. It’s often called the driest place on Earth. Yet here, the endless expanse is not only sand, but also towering heaps of trash: discarded tires, cars, old clothing, and shoes.

Chile has long served as a global hub for secondhand clothing and unsold apparel. According to state broadcaster CCTV, more than 46,000 tons of used clothing entered the country in 2021. Even in a place where rocks weather easily into gravel, garments can take centuries to decompose, depending on fiber type.

Half a world away, at the desert’s antipode, is Guangdong, China, a critical global hub for apparel manufacturing. Clustered production, flexible manufacturing, and supply chain innovation mean garments produced here can reach global markets faster, better, and at lower cost.

The antipode marks the two farthest points on Earth, and Guangdong and the Atacama Desert frame the fashion industry’s extremes: production and disposal. A piece of clothing leaves a factory, travels the globe, and ends up in a landfill where it may never fully degrade.

Faced with mounting textile waste, governments are building circular systems to keep materials in use. Some companies aim to reconnect the industry’s endpoints, closing the loop from disposal back to production. Regrowblu, a Guangzhou-based brand focused on regenerative textile technology, said it is tackling the problem at the source: recycled fabric. It aims to drive sustainable supply chain innovation.

Like many attempts to restructure industrial chains, technology is the lever. As a recycled fabric R&D and manufacturing company, Regrowblu has reportedly developed patented textile engineering and materials science technologies that can recycle up to 95% of waste textile materials, enabling the mass production of 100% recycled fabrics.

“We’ve brought the minimum order quantity for our recycled fabrics down to 500 yards. Just two yards is enough for a pair of denim jeans, at a price of RMB 45 (USD 6.3) per yard,” Regrowblu founder YK told 36Kr. “This makes it possible for independent designers, boutique labels, and international brands to experiment with recycled fabrics.”

According to YK, Regrowblu is the world’s first company to achieve 100% recycled material in mass production. Lower costs, the company says, are made possible by its proprietary smart loom, which boosts production efficiency and minimizes waste. If validated at scale, this could expand the market for recycled materials and accelerate upgrades in circular textile technology and apparel manufacturing.

Sizing denim’s footprintThe textile and apparel sector has long been one of the major sources of pollution and carbon emissions. Data from the International Energy Agency estimates the industry accounts for about 10% of global carbon emissions, producing more than international aviation and shipping combined, ranking second only to oil among polluting industries.

Meanwhile, textile recycling rates remain low. Public data indicate that the European Union generates around 12.6 million tons of textile waste each year but recycles only about 22% of it, mostly through downcycling into rags or stuffing. Less than 1% achieves true fiber-to-fiber circularity.

YK first encountered ESG (environmental, social, and governance) concepts while studying at the Brera Academy in Milan. Later, as a fashion product designer in China, she saw clearly that solving the textile recycling challenge required tackling the problem upstream, at the fabric level.

“Whether you look at the percentage of eco-friendly or recycled fibers in a single product, or at the share of sustainable items in a brand’s overall product mix, the numbers are still low,” YK said. “Marketing can raise awareness, but without substantive supply, green consumption can’t truly take hold, and the industry’s environmental and climate impact remains far from resolved.”

In 2016, with a pre-Series A investment from family fund Chung Holdings and technical support from its textile manufacturing arm, YK and her partners began developing recyclable fabrics upstream in the supply chain.

While most recycled fabrics today are made from discarded polyethylene terephthalate (PET), a petroleum-based synthetic fiber that can already be mass produced through physical or chemical processes, cotton fiber recycling still faces significant bottlenecks. This is Regrowblu’s current focus.

Cotton-based recycled fibers often lack sufficient tensile strength, leading to thread breakage during weaving. Regrowblu said its team has combined physical, chemical, and biological processes to minimize pollution at each step. Over three years, it ran recycling trials on more than 10,000 tons of material and developed over 3,000 SKUs.

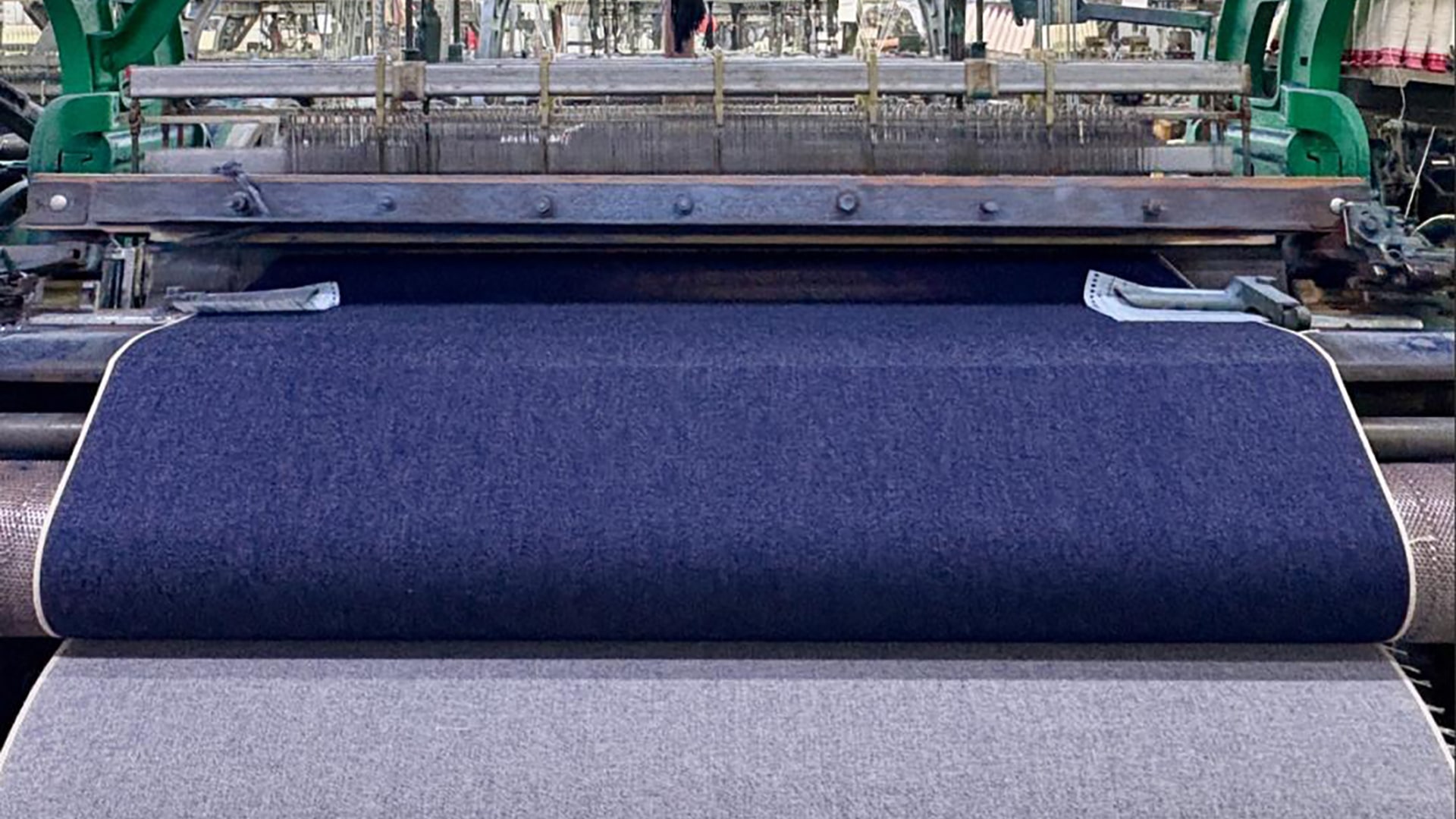

“In the 42nd test of our #627810 (technical number) process, we finally achieved a major breakthrough: the world’s first traditional denim fabric made entirely from 100% natural recycled fibers, suitable for mass production,” YK said. The fabric’s tensile strength, tear resistance, and colorfastness to both dry and wet rubbing reportedly meet national CMA (China Metrology Accreditation) testing standards, matching the performance of virgin cotton fabrics.

Regrowblu named this denim fabric delta-42. Denim, commonly used for jeans, is among the most resource-intensive textiles. According to the United Nations Environment Programme, a single pair of jeans, from cotton farming to manufacturing, retail, and consumer use, consumes about 3,781 liters of freshwater and produces 33.4 kilograms of carbon emissions.

By using recycled inputs and new manufacturing processes, one yard of delta-42 saves roughly 2,275 liters of water and cuts carbon emissions by 3.15 kilograms. Producing a standard women’s jeans with two yards of delta-42 reduces emissions by around 6.3 kilograms, which is equivalent to the carbon sequestration of a single elm tree over one year.

Currently, Regrowblu’s recycled fabrics are already in mass production. Its first factory in Guangzhou has an annual capacity of three million yards. Before 2023, most of the company’s profits came from overseas ODM (original design manufacturing) business, but it has since expanded into the domestic market.

In 2024, Regrowblu said it generated over RMB 50 million (USD 7 million) in annual revenue and secured contracts with international luxury brands and major FMCG (fast-moving consumer goods) labels to supply recycled fabrics.

Driving down minimum order quantities and pricesA single point of technological innovation can create breakthroughs when resources are concentrated. But in the traditional apparel industry, production costs remain the most sensitive factor, shaping both adoption and market penetration.

“Most companies will ask if using recycled fabrics will be expensive, whether the minimum order quantity will be high, or if retail prices can absorb the extra cost. Even top players in the industry think this way,” YK said. “The most direct way to answer those concerns is to drive the price and order quantity down.”

Internationally, products with low recycled content typically sell for around RMB 200 (USD 28) per yard. Due to the instability of recycled materials, high MOQs (minimum order quantities), long lead times, and high prices, stable commercialization has been difficult. Leveraging breakthroughs in material technology, textile machinery, and its cluster of supply chain resources, Regrowblu has lowered the price to RMB 45 (USD 6.3) per yard, with an MOQ of 500 yards.

When the factory’s second phase begins production in September, the company expects annual capacity to double to six million yards. The minimum order may fall from 500 to 300 yards, lowering procurement barriers for sustainable fabrics and enabling more brands to make the transition.

At present, customers can order fabric samples via Regrowblu’s self-developed mini program for RMB 225 (USD 31.5), making recycled fabrics more accessible to designers, independent labels, and small businesses.

“We hope this mini program will serve as a bridge, letting more designers and small brands in China try recycled fabrics with a MOQ of just 500 or even 300 yards. Flexible production can then meet the standards for sustainable products,” YK said. “This model lowers entry barriers, shortens product development cycles, boosts responsiveness, and empowers green transformation. It also bypasses some of the opaque procurement practices in the traditional supply chain, further cutting costs and improving efficiency.”

In conventional textile manufacturing, entrenched practices such as relationship-based networking, advance payments, and indefinite payment cycles can leave suppliers under financial pressure and facing operational risk.

Regrowblu’s goal is that a more flexible and direct sales model will let customers quickly purchase sustainable fabrics for immediate product development, shortening decision-making cycles and making the supply chain more transparent. While this approach is currently better suited to small and mid-sized enterprises, the company sees it as a step toward broader change.

In the longer term, Regrowblu plans to extend into textile waste collection. During a site visit with a local clothing recycler, YK found that clothes were sorted by category and condition rather than by material, limiting opportunities for high-value recycling.

Globally, the trade in secondhand textiles has long shifted the waste burden to developing countries. For example, Ghana’s Kantamanto market receives 15 million garments each week, 40% of which cannot be sold due to a lack of processing facilities, and end up burned or dumped.

Regrowblu’s recycling strategy is being rolled out in two phases: first, scaling the collection and reuse of pre- and post-consumer textile waste; next, using its third factory in China as a hub to complete the closed-loop system, then replicating it nationwide and expanding internationally. “Our ultimate vision is a zero-waste, zero-carbon future,” YK said. “We want to use regenerative technology to maximize the value of recycled resources, building a closed loop that truly enables a fiber-to-fiber revolution.”

From behind the scenes to center stageChina’s manufacturing sector holds a central position in the global supply chain, often behind the scenes. As competition shifts from cost efficiency toward brand value, moving up the value chain through branding is becoming inevitable.

For China’s recycled textile technology brands, that means building influence from the source, much like how today’s electric vehicle battery brands play a decisive role in consumer purchasing decisions based on their technological approach.

Under pressure from carbon reduction policies, many international brands have embraced circular economy strategies. In October 2024, Puma partnered with French company Carbios to launch apparel made entirely from waste textiles using new biorecycling technology. In June this year, fashion group Mango teamed up with Swedish sustainable materials company Circulose to transition its MMCF (man-made cellulosic fiber) usage to Circulose material, made from 100% discarded textiles.

China’s “3060” carbon strategy includes guidance on accelerating the recycling of waste textiles, targeting a 30% recycling rate by 2030 and annual output of three million tons of recycled fibers.

Although Regrowblu began supplying recycled fabrics to international luxury and FMCG brands in 2024, it said geopolitical factors have limited its visibility, blunting the impact of its technology on brand recognition.

“No matter how much overseas design teams value the benefits of our high-recycled-content fabrics, it doesn’t guarantee brand exposure,” YK said. She is determined to boost Regrowblu’s profile among B2B customers and build recognition among consumers:

The company’s revenue has reportedly grown more than 110% year-on-year for three consecutive years. While brand value takes time to develop, steady income from ODM orders overseas has underpinned expansion and domestic market entry.

With these profits, Regrowblu said it has been able to afford local clients the opportunity to try products first before placing larger orders. Through the mini program, domestic orders can be fulfilled in as little as two weeks. The company’s fabrics are now used by brands across Alibaba’s Taobao ecosystem and lifestyle platform Xiaohongshu.

Ultimately, consumers are the endpoint for any brand, and a functioning circular textile system cannot be built without their participation.

On the consumer side, angel investor Seven partnered with Regrowblu to co-found the circular design brand Odeuxplan. Through the brand’s mini program, shoppers can buy clothing, hats, and other items made from recycled fabrics.

Unlike traditional fashion brands, Odeuxplan treats the purchase as the beginning of a product’s journey. Each product has a unique ID that, once activated, lets consumers track usage days and carbon footprint. The longer an item is used, the higher its buyback value when returned to the platform. Customers can also trade in old clothes, including from their own closets, for credit toward new purchases.

“With Regrowblu’s underlying technology, old clothes transform from waste into a readily accessible resource bank,” YK said. “By providing visible incentives, we hope to encourage both consumers and brands to participate in circular systems. As people begin to consume, recycle, and consume again, high-value materials can keep flowing back into our production lines, avoiding landfills entirely and cutting the environmental burden from waste at the source.”

From consumer awareness to brand development, from recycling networks to closed-loop systems, both mindsets and industrial chains are evolving. The choices we make in designing, consuming, and assigning value to clothing will shape the paths those garments take next.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Zhang Bingbing for 36Kr.

...Read the fullstory

It's better on the More. News app

✅ It’s fast

✅ It’s easy to use

✅ It’s free