Nvidia’s Thor chip setbacks test automaker confidence, opening doors for rivals

4 天前

Nvidia’s flagship chip for automotive artificial intelligence, Thor, is facing consecutive delays, raising the risk of losing key customers.

According to 36Kr, Thor was initially planned for mass production in mid-2024, but this timeline has since been pushed back till mid-2025, and even then, only the entry-level version will reportedly be available. This delay has disrupted the product timeline of some Chinese automakers. Multiple industry sources told 36Kr that Xpeng Motors is considering shelving the use of the Thor chip in its upcoming vehicles next year.

“Thor has been delayed to the point where companies’ self-developed chips are already mature,” one industry insider said.

During Nvidia’s Global Technology Conference (GTC) last March, Xpeng unveiled plans to integrate the Thor chip into the AI systems of its upcoming electric vehicles. However, delays led the newly launched P7+ to adopt Nvidia’s second-generation Orin chip instead.

Another source told 36Kr that Xpeng is accelerating the integration of its self-developed smart driving chip, Turing. This chip has already been prototyped, and Xpeng is currently testing its stability and performance. “Navigation Guided Pilot” (NGP), its driving assistance system, is said to have already been tested on “XP5,” the internal codename for the chip.

At the same time, sources revealed that Nio has not secured Nvidia’s next-generation Thor chip for its vehicles slated for next year. In July, Nio announced its self-developed chip, Shenji NX9031, had entered the prototyping phase. Similar to Xpeng, Nio’s vehicles next year will incorporate its Shenji chips and Nvidia’s Orin chips—but not Thor.

Both Xpeng and Nio declined to comment when 36Kr approached the companies for comment.

Xpeng and Nio were among the earliest automakers to adopt Nvidia’s first two generations of automotive AI chips. In 2018, Nvidia released its first-generation smart driving chip, Xavier, and Xpeng was the first to mass produce vehicles equipped with it. The P7 model, launched in 2020, used Xavier’s 30 TOPS of computational power to enable highway navigation-on-autopilot (NOA) functionality.

In 2021, Nvidia introduced its second-generation chip, Orin. The following year, Nio integrated four Orin chips into its ET7 model, achieving a total computational power of 1,000 TOPS. Orin quickly became the mainstream choice for smart driving systems.

While Xpeng and Nio have not remained launch partners for Thor, Nvidia’s latest chip, designed for AI and large models, continues to draw interest from automakers. Companies such as BYD, Zeekr, and Li Auto have all announced plans to adopt the Thor chip.

However, even Li Auto, one of Thor’s first adopters, is reportedly developing its own smart driving chip under the codename “Schumacher.” An insider said that Li Auto is working on its next-generation end-to-end (E2E) solution: a vision-language-action (VLA) model that will pair with its in-house chip, expected to launch in 2026.

Market analysts have high expectations for Thor, predicting it could become Nvidia’s second major growth driver beyond its data center business. However, Nvidia’s third-quarter financial results for fiscal year 2025 show that automotive chip revenue currently accounts for just 1% of its total revenue.

At present, the Orin chip remains Nvidia’s mainstay in the automotive AI market. Last year, Nio CEO William Li said that Nio’s procurement of smart driving chips accounted for 46% of Nvidia’s global shipments in 2023. Based on Nio’s sales of 160,000 vehicles last year, with each car equipped with four Orin chips, the company purchased approximately 640,000 chips. This rough estimate suggests that Nvidia’s total Orin sales in 2023 reached 1.39 million units.

As smart driving adoption grows, Orin will remain Nvidia’s key product for sustaining high shipment volumes and market share. However, delays to Thor and the potential loss of customers could present significant challenges for Nvidia’s automotive AI chip business next year.

Thor’s repeated delays deepen automakers’ concerns over chip supplyThe push for smart driving technology has reached unprecedented levels in China. As the hardware platform underpinning E2E systems and AI large models, Nvidia’s latest automotive AI chip, Thor, has drawn widespread industry attention.

Thor was first unveiled at Nvidia’s GTC during the fall of 2022. It features two main versions offering 750 TOPS and 1,000 TOPS of computational power, respectively.

Nvidia’s established strategy for launching new products involves identifying potential customers and developing standard products for the market. At the 2024 GTC, automakers such as Xpeng, Zeekr, BYD, and Li Auto all announced collaborations involving Thor.

However, Thor’s production timeline has been repeatedly pushed back. A source close to Nvidia told 36Kr that Thor’s mass production, originally planned for mid-2024, has now been delayed by at least a year.

Nick, the product lead for Xpeng’s P7+, stated on a community platform that there is no confirmed SOP date for Thor. He added that a 2026 release would already be seen as a positive outcome.

An insider close to Nvidia revealed to 36Kr that Thor may have encountered issues with its chip architecture.

According to a chip industry expert, Thor integrates Nvidia’s latest high-performance GPU architecture, Blackwell, which is specifically designed for transformer models, large language models (LLMs), and generative AI workloads.

However, Blackwell chips have faced numerous production challenges this year. Manufactured using TSMC’s 4-nanometer process, each chip contains 208 billion transistors. While Nvidia initially planned to ship Blackwell chips by Q2 this year, production was delayed.

According to multiple media reports, TSMC engineers identified a design flaw in the chip’s die connections ahead of mass production, impacting yield rates and overall production capacity.

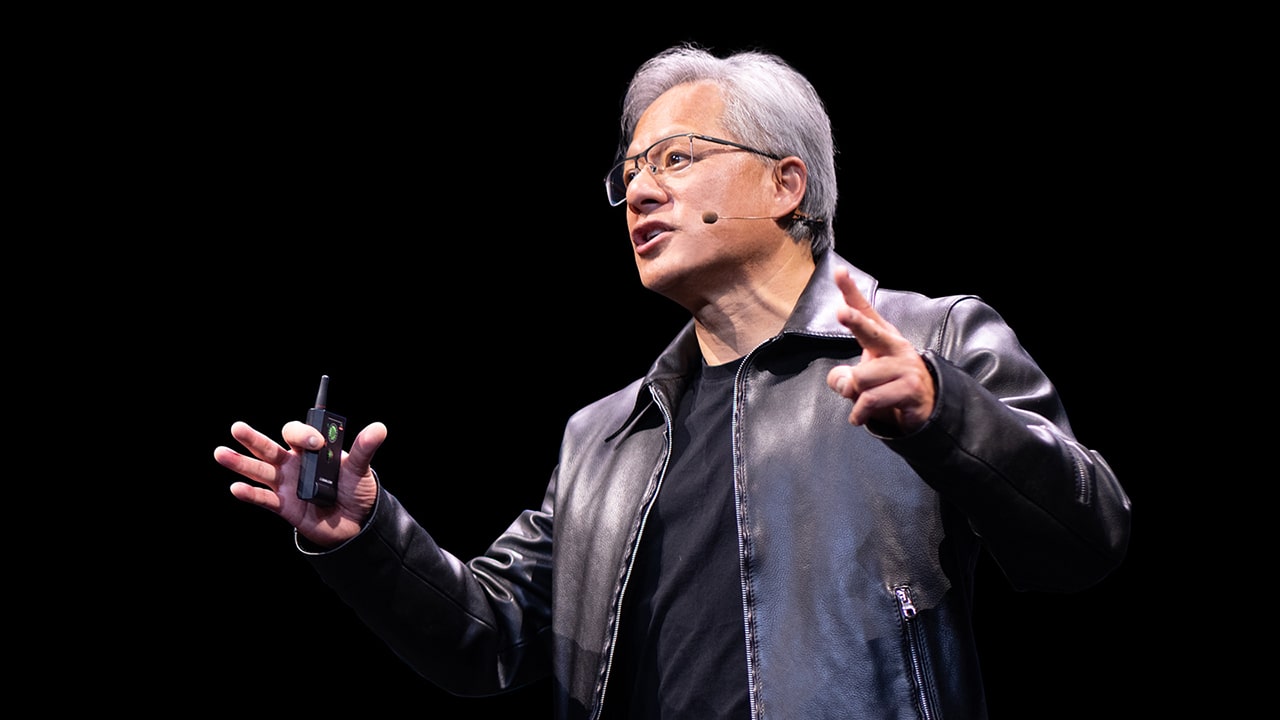

“We had a design flaw in Blackwell… It was functional, but the design flaw caused the yield to be low. It was 100% Nvidia’s fault,” CEO Jensen Huang previously admitted publicly.

With assistance from TSMC, the design flaw in Blackwell has since been resolved. However, as a new product, Blackwell still faces considerable production challenges.

Media reports indicate that Blackwell utilizes TSMC’s CoWoS-L packaging technology, which has its own yield issues. Additionally, Blackwell chips are said to have thermal design shortcomings. This raises concerns that Thor could encounter similar production challenges, potentially forcing automakers to adjust their product development timelines.

As automakers start pursuing alternatives, including developing their own chips, the benefits of self-developed chips are becoming evident. Tesla has already demonstrated this with its HW3.0 hardware, released in 2019, which can still support upgrades to E2E systems five years after its launch. As emerging players roll out their own chips, Nvidia’s Thor—still in its infancy—may face an uphill battle.

Meanwhile, competition in the automotive market has intensified. Any changes to automakers’ products require adjustments to materials, sales channels, and production schedules—all deeply interconnected. More critically, the market window for key models can often be just a few months.

To remain competitive, automakers have compressed new vehicle development timelines to 12–18 months and now demand annual cost reductions of 10% across the supply chain. However, automakers, traditionally accustomed to controlling their supply chains, are facing increasing pressure from dominant suppliers like Nvidia and CATL.

Nvidia’s automotive chip business needs stronger risk resistanceThor’s challenges are becoming increasingly apparent. Delays have led some automakers to pivot toward developing their own chips, turning former partners into potential competitors. Even if Thor is successfully mass produced next year, breaking into the market quickly is not guaranteed.

2025 is anticipated to be a pivotal year for the broader adoption of smart driving technology. After a year of intense competition, both new and established players are striving to integrate smart driving capabilities into vehicles priced around RMB 150,000 (USD 21,000).

In this segment, automakers are placing a stronger focus on controlling the bill of materials (BOM) costs, while consumers are increasingly prioritizing value for money. In response to this market shift, Nvidia has introduced three chip options:

“Orin Y is the version Nvidia is actively pushing,” an industry insider said.

Publicly available information shows that Orin took Nvidia four years and billions of dollars in investment to develop. If Orin remains Nvidia’s primary revenue driver, its automotive revenue for 2022 and 2023 was USD 566 million and USD 903 million, respectively. Combined with this year’s revenue, Orin’s total earnings might barely cover its development costs.

As smart driving becomes more common next year, Nvidia’s Orin N and Y chips are expected to capture a larger market share. It’s common in the semiconductor industry for older products to continue generating strong sales volumes due to factors like pricing, performance, and market demand, even after new products are released.

Lowering prices can also drive higher shipment volumes and revenue. In November, Nvidia reported Q3 results for FY2025 (from August 3 to October 27, 2024), with total revenue of USD 35.1 billion. Data center revenue accounted for nearly 90% of this total, while automotive chips represented just 1%.

The good news is that Nvidia’s automotive chip business showed 72% year-on-year growth and 30% quarter-on-quarter growth in that quarter. This growth was primarily driven by increasing demand for autonomous driving chips and Nvidia’s chip sales to robotics companies.

However, in this market, Chinese players have started entrenching themselves, and with strict cost controls in place, it will not be easy for Nvidia to achieve high profit margins.

Moreover, the landscape for Thor is markedly different from when Orin was launched. At the time of Orin’s debut, Chinese automakers were entering an aggressive phase of smart driving development, and competition remained relatively nascent. In contrast, Thor has emerged in an era defined by high computational power for in-vehicle AI but now faces greater uncertainty and stronger alternatives. Should emerging players successfully mass-produce their own chips, the industry’s reliance on Nvidia’s Thor could further decline.

Another challenge for Nvidia is its relative lack of integrated smart driving software solutions. Over the past year, former Xpeng’s head of autonomous driving Wu Xinzhou has been leading Nvidia’s efforts to close this gap. According to sources cited by 36Kr, Nvidia’s first-generation software prioritizes nationwide functionality and operates without relying on high-definition maps.

“They are still in the 0–1 validation stage. Wu Xinzhou works extremely hard, often personally testing demos on vehicles, and these demos are updated daily,” said an insider familiar with Nvidia’s progress. However, this approach is said to lag behind the E2E approach that leading companies started adopting a year ago.

Nvidia’s slower progress in this aspect has led its customers to explore other solutions. For instance, Mercedes-Benz has adopted the E2E solution from Momenta and will integrate it into its new CLA model. In addition, Momenta’s technology is being implemented in models by BYD’s Denza, SAIC Motor’s IM Motors, and GAC Toyota.

Of course, Nvidia’s Thor remains a benchmark for on-device computational power in the AI era. Automakers without in-house chip solutions, as well as those aiming to compete with Tesla, may still find Thor an attractive option.

However, if Nvidia can enhance its integrated software and hardware capabilities, it would not only drive growth in its automotive business but also strengthen its understanding of the Chinese smart driving market. With automotive revenue currently representing just 1% of Nvidia’s total earnings, the segment requires a more robust foundation to mitigate risks and ensure long-term stability.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Li Anqi for 36Kr.

...Read the fullstory

It's better on the More. News app

✅ It’s fast

✅ It’s easy to use

✅ It’s free