The EPF ‘VE’ hack: How contributing just 2pc more could boost your retirement savings

1 天前

KUALA LUMPUR, Oct 1 — Have you always wanted to save more for your retirement but somehow end up spending it up every month? Or maybe it’s more convenient to have money automatically deducted from your salary into your Employees Provident Fund (EPF) account.

The answer may lie in EPF’s Voluntary Excess (VE), which is where Malaysians can contribute more than is legally required from their salaries into their retirement savings.

Option One: Voluntary Excess (VE)

Under Malaysian law, 11 per cent of your monthly salary must be deducted and contributed to your EPF savings, while your employer must contribute 12 or 13 per cent of your salary, depending on whether it is above or below RM5,000.

EPF’s Relationship & Advisory (RA) adviser Mogana Murugan @ Arujunan said you can voluntarily contribute more than 11 per cent from your salary every month, by using VE.

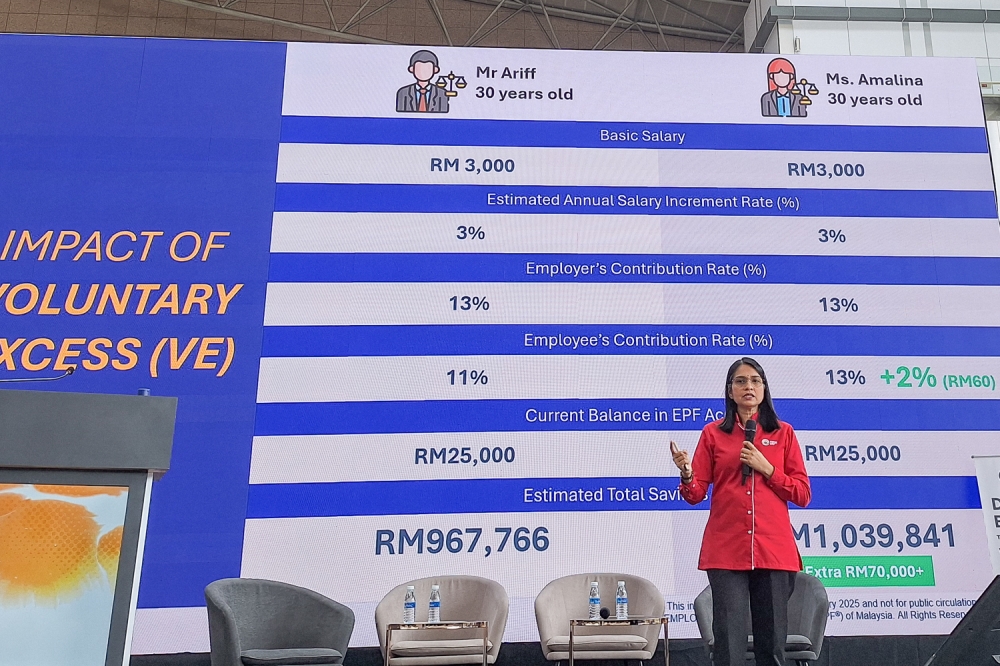

She gave a hypothetical example to illustrate the impact of how even choosing to contribute 13 per cent of your salary (meaning just two per cent more) can significantly boost your EPF savings.

Mogana compared two fictional individuals aged 30 (“Ariff” and “Amalina”) who both have the same current monthly salary of RM3,000, an estimated annual salary increment of three per cent, and the same current EPF savings of RM25,000.

In the example, Ariff, who stuck to the mandatory 11 per cent contribution, could have more than RM967,000 in estimated retirement savings by age 60.

Amalina, who used VE to contribute 13 per cent (11 per cent mandatory and 2 per cent voluntary), could have more than RM1,039,000 in savings by age 60, aided by EPF annual dividends and compounded growth.

This is based on the assumption of no pre-retirement withdrawals and a hypothetical annual five per cent in EPF dividend.

“This person just topped up two per cent, which is only RM60 a month. But this person at the age of 60 already has RM1 million, okay? RM1 million, which is extra RM70,000.

“So a small amount can give a big impact on EPF savings,” Mogana said at a talk titled “EPF & You: Retire Comfortably” at the Malaysian Bar’s recent MyBar Carnival.

Based on Malay Mail’s own calculations, this example would involve Ariff contributing RM330 or 11 per cent of his RM3,000 salary to his EPF savings every month at age 30, while Amalina would contribute RM390 (RM60 more) each month.

Assuming Amalina’s salary increases by three per cent every year and her contribution remains at 13 per cent until age 60, she would be paying an extra amount each month: about RM71 more (compared to Ariff) by age 36; RM80 by 40; RM90 by 44; RM108 by 50; and RM145 by 60.

Do note, this example is just a mere simulation and illustration to show how just saving a little bit extra could benefit you.

The actual total EPF retirement savings after using the VE method would depend on multiple factors, such as actual salary increments, the annual EPF dividend rate, and whether any pre-retirement withdrawals were made.

If you want to run a similar simulation of your estimated EPF savings by age 60, go to your i-Akaun app, and look for the icon that says “Estimate your retirement savings” and click “Calculate Now”.

How to do VE

An advantage of using VE is that there is no maximum limit on the amount or percentage of your salary that you can contribute to your EPF savings.

Mogana shared a real-life example of an EPF contributor who used VE to contribute 40 per cent of his salary every month, noting, however, that he had a second income and was a conservative investor who used EPF as his main investment vehicle.

Signing up for VE is easy, just download and fill up the form from EPF’s website and pass it to your employer.

Option Two: Topping up your EPF savings whenever you want

Mogana said the other option is “self-contribution”, where you can voluntarily top up your EPF savings by up to RM100,000 every year.

“So besides your mandatory contribution, if you have extra savings, or if you have a second job, or you have any passive income, you can top up in EPF as well,” she said.

All you have to do is use your i-Akaun app to top-up your savings.

Click on the “Increase savings: Top-up now” button, click “skip” when prompted to register for i-Saraan (since i-Saraan is for the self-employed and gig workers without fixed income), enter the amount you want to contribute under the “self” category, and then make the transfer from your bank account.

Quick summary of differences between the two voluntary top-up options

Voluntary Excess: Automated monthly deduction from your salary at a fixed percentage, which enables a consistent and disciplined setting aside of extra funds for retirement.

Self-contribution: You have to make the effort to remember and manually save more for retirement, but there’s also flexibility to decide when and how much to top-up.

Under the “self-contribution” option, there is also a free “Auto Tambah” feature in i-Akaun to help you deduct a fixed amount from your bank account on a fixed date every month. This automatic function is currently only available for RHB and AmBank customers.

How much do I need for retirement anyway?

You can start contributing to your EPF savings at age 14, and you can only continue contributing until age 75.

EPF will continue to give you dividends every year until age 100, provided you still keep your savings there.

According to Mogana, the amount you need to have a comfortable retirement will depend on your lifestyle. You would also need to take into account inflation.

...Read the fullstory

It's better on the More. News app

✅ It’s fast

✅ It’s easy to use

✅ It’s free